Monetary assistance to families raising children with special needs is one of the important indicators of social security. Those receiving benefits for caring for a disabled child were waiting for when and how much the increase would come. Now the answer has been received and the conditions have been determined.

- How much is the benefit?

- Benefit for non-working parents

- How benefits are indexed for children with disabilities

- Fringe benefits

- How to make a payment

- Allowance for caring for a disabled child: when and how much will the increase be?

- Will there be an increase in payments?

- When will the allowance for caring for a disabled child be increased?

- Amount of benefit for caring for a disabled child

- Allowance for caring for a disabled child for a non-working parent

- Indexation of benefits for disabled children

- What additional benefits and payments are entitled?

- What is needed to receive payments

- Conditions

- Documentation

- Benefits for non-working parents: payment procedure (documents)

- Who is eligible for benefits?

- Benefits for non-working parents

- Procedure for applying for benefits for non-working parents

- Ways to receive payment

- Calculation of child care benefits in the Social Insurance Fund

- Refusal to pay benefits

- Pension for non-working parents

- The Ministry of Labor will think about paying benefits to working parents of disabled children | Mercy.ru

- Labor benefits for parents of disabled children

- Benefits for parents of disabled children during employment

- What labor benefits are provided to parents of a disabled child?

- Expert opinion

- Payment for additional days off for parents of a disabled child

- Documents for receiving payments for additional days off

- Additional measures to support parents raising a disabled child in 2020

- Common Mistakes

- Question answer

- Case from practice

- Question to Putin: why do only non-working able-bodied parents or guardians receive benefits for caring for disabled people?

- Pension of a disabled child - amount, exact amount

- Conditions for assigning social benefits to a disabled child

- Social pension for disabled children

- Amount of compensation for caring for a disabled child

- How much do disabled children receive?

- Social pensions for disabled children

- How much do disabled people of groups 1, 2 and 3 receive in total?

- What should parents of children with disabilities do?

How much is the benefit?

Raising a child whose physical capabilities are limited for various reasons is not just a great responsibility, but also serious material costs with great moral stress. In 2020, persons caring for disabled children received the following payments:

- 5,500 rubles per month – mother, father or adoptive parent of a child with the status of “group I disabled child”, until the child turns 18 years old;

- 1,200 rubles per month – other relatives (grandparents, aunts, uncles) who are in charge of a child with a disability.

The allowance for caring for a disabled child will increase in 2020. But the amount will be slightly less than the public expected, since the bill to increase the benefit to 12 thousand rubles was not adopted by the State Duma.

The corresponding measures are stated in the Decree of the President of the Russian Federation No. 95 of 03/07. 2020 - he introduced amendments to Decree of the President of the Russian Federation dated February 26, 2013 No. 175 “On monthly payments to persons caring for disabled children and disabled children of group I” (hereinafter referred to as Decree No. 175).

The changes apply to able-bodied parents who are unable to work due to the fact that they are forced to constantly care for an incapacitated child. The allowance for disabled children under 18 years of age, or more correctly for their caring parents, has been increased by 4,500 rubles and will amount to 10 thousand rubles. The decree comes into force on July 1, 2020.

Benefit for non-working parents

In Russia, guardians or parents who care for children with special needs receive social assistance from the state (this payment should not be confused with the child’s disability pension). Since the adoption of the decree in 2013, this benefit has never been increased. And this type of child benefit is extremely important for families, since much more money is spent on a child with a disability than on a healthy member of society. Additionally, families need:

- medical equipment and medicines;

- special shoes and clothing;

- visiting the pool, physical therapy, health improvement, rehabilitation;

- vitamins and special nutrition.

Already in the second half of the year, benefits for unemployed parents of disabled children will amount to 10 thousand rubles. For other relatives who cannot work due to caring for children with disabilities, no changes will occur. The payment amount will remain at 1,200 rubles.

Payment documents will not be accepted if the mother/father has a job or part-time job. In this case, the state provides other benefits:

- additional 4 days of vacation;

- deduction for personal income tax (up to 12 thousand rubles);

- the right to choose vacation time;

- the employer can dismiss such an employee only with his consent.

How benefits are indexed for children with disabilities

According to decree No. 175 in the new edition, now social payments to families with a disabled child will be indexed annually. This measure has not been mandatory for payments in this category since 2005.

How much the amount of financial assistance will increase will depend on the level of inflation recorded in the state. For example, from February 1 of this year, social benefits were indexed by 4.3%.

According to expert forecasts, in 2020 the inflation threshold is expected to reach 5.5%. In this case, from February next year, the allowance for caring for a disabled child of group 1 may increase by 550 rubles.

Fringe benefits

In addition to the mandatory benefits that non-working parents and guardians of disabled children receive, the state provides a number of additional benefits:

- Pension for children with disabilities (from April 1, 2020 is 12,400 rubles). To assign it, it is necessary that the recipient of the benefit permanently resides in the territory of the Russian Federation.

- Financial compensation paid monthly (from February 2020 is 2,700 rubles). Covers the costs of necessary medications, travel on public transport, and treatment in a sanatorium.

- Possibility of receiving compensation for social services in cash.

- Tax deduction - 6,000 rubles for guardians and 12,000 for parents.

- The ability to use maternity capital money to purchase medical devices and means of physical adaptation.

- Additional 4 days of leave every month for the father or mother of the child, taking into account these days in the insurance period.

How to make a payment

To apply for a benefit for caring for a disabled child, you must go through several stages:

- Confirm disability. To do this, you need to contact a pediatrician, take the necessary tests, diagnose the disease and undergo the treatment process. Based on the results of all these procedures, a special commission issues an expert opinion.

- Apply for a pension due to a disabled child. For this purpose, you need to contact the branch of the Pension Fund of the Russian Federation. You must have with you: an application, a passport, a birth certificate of the benefit recipient, proof of residence on Russian territory, a medical report.

What is important to consider when registering:

- Social benefits can be issued to a father or mother, a grandmother or grandfather, one of the other relatives, a guardian or an adoptive parent.

- Only a Russian citizen who is of working age but is not working due to the need to care for a child with a disability can submit an application.

- If the applicant is a recipient of wages, pensions, unemployment benefits, or any other payment from the state, he is not entitled to benefits for caring for a disabled child.

- Payment of benefits is carried out until the child reaches the age of majority or until the medical certificate expires.

- When a child reaches 18 years of age, only persons caring for disabled people belonging to group I can receive benefits.

- Only one applicant can receive a payment in this category.

You can submit an application in one of the following ways: to a branch of the Pension Fund of Russia, on the State Services portal or through the MFC. The applicant must have with him a certain package of documents:

- Guardian's identity card (original and copy).

- SNILS (original and copy).

- Birth certificate of the child being cared for due to disability.

- A certificate from the Pension Fund stating that the applicant is not a recipient of a pension.

- An extract issued by the employment center stating that the candidate for payments is not registered.

- Employment history.

- Medical documents confirming the child’s disability (conclusion of the expert commission).

- Statement.

In some cases, you are asked to provide additional documents:

- birth certificate of the parent filing the petition (when the benefit is issued to a grandparent);

- certificate from place of residence;

- military ID;

- court decision and so on.

When filling out the application form, you must provide the following information:

- Last name, first name and patronymic of the child and the person who will care for him.

- The applicant's contact information, including the telephone number where he can be contacted.

- Information from the applicant's civil passport.

- Date of birth of the child.

- List of documents that are attached to the application.

There is no need to submit a separate application for recalculation of payments.

The need to increase benefits is dictated by the desire to protect families raising disabled children from the risk of falling below the poverty line.

Source: https://zakon7ya.ru/imushhestvennye-obyazatelstva/pomoshh-semjam/posobie-po-uxodu-za-rebenkom-invalidom.html

Allowance for caring for a disabled child: when and how much will the increase be?

The allowance for caring for a disabled child in 2020 will increase for unemployed parents by 80% - up to 10 thousand rubles from the second half of the year.

Will there be an increase in payments?

Now in Russia, citizens who care for disabled people are paid the following amounts:

- 5,500 ₽ – to the mother, father or adoptive parent of a disabled person until the ward reaches the age of majority, or if the person is a disabled child of group I;

- 1,200 ₽ – other relatives (grandmothers, aunts, children) caring for people with disabilities.

The changes will affect able-bodied parents who cannot work due to the need to constantly care for a disabled child; they will receive an additional 4,500 rubles, for a total of 10,000 rubles per month. There is no increase provided for other guardians.

The figure of 10 thousand ₽ is close to the minimum wage - how much a father/mother could earn if they were employed and not forced to look after children.

When will the allowance for caring for a disabled child be increased?

Maintenance assistance is paid to parents or other guardians and should not be confused with a disability pension. Current social payments for the care of minors with disabilities have not been increased since 2013.

Families with such children dream of increasing social benefits, since the current amount is not at all sufficient for survival.

A disabled child requires much more maintenance costs compared to a healthy person; additionally the following is required:

- Special shoes and clothing.

- Medicines and medical equipment.

- Therapeutic exercise, visiting the swimming pool, early development courses, rehabilitation and wellness.

- Special nutrition and vitamins.

The increase in benefits for caring for a disabled child will increase not in January, but from July 1, 2020, the bill was initiated by the President, after considering a petition from activists.

Amount of benefit for caring for a disabled child

The amount of the allowance for caring for a disabled child (from the second half of the year) will be:

- 10 thousand ₽ rubles – transfers to one of the parents caring for the child to the detriment of employment;

- 1.2 thousand ₽ (no changes) – assistance to other relatives who are caring for a disabled person.

Such an increase will certainly have a positive impact on the well-being of this category of citizens, but unresolved problems still remain:

- Persons of disabled age cannot receive assistance.

- Transfers to non-parents have been kept at the same minimum level of 1,200 rubles.

- If the guardian works a little extra money, he does not receive help.

Allowance for caring for a disabled child for a non-working parent

Documents will not be accepted if the mother officially works part-time, then she is entitled to the following privileges:

- tax deduction for personal income tax up to 12,000 rubles;

- additional vacation 4 days per month;

- the right to independently choose a convenient vacation period;

- also, she cannot be fired without consent.

Indexation of benefits for disabled children

The new law on increasing benefits for caring for disabled children in 2020 provides for mandatory annual indexation of payments. This measure has not been applied to current payments since 2005.

The indexation amount is comparable to the inflation rate, for example: from February 1, 2020. Social payments were indexed by 4.3%. In 2020 inflation is expected to be 5.5%, which means that from the second month of next year, social payments for caring for children with disabilities may increase by 550 rubles.

What additional benefits and payments are entitled?

In addition to the monetary supplement for services, other benefits are provided for children with disabilities:

- The social pension for a disabled child - from 04/01/2020 is 12.4 thousand rubles, assigned to children who permanently reside in the territory of the Russian Federation.

- Monthly cash compensation - from February of the current financial period is 2.7 thousand rubles, this includes: medicines, vouchers to a sanatorium, free train and train travel.

- Compensation for social services can also be received in cash.

- Use of maternity capital funds for adaptation and medical devices.

- Tax deduction – 12 thousand rubles for parents and 6 thousand rubles for other guardians.

- Additional leave 4 days a month for dad or mom, taking into account the insurance period during courtship.

What is needed to receive payments

To apply for social assistance for a guardian, you must go through the following steps:

- Confirmation of disability, first you contact a pediatrician, take tests, undergo diagnostics and a course of treatment, then you need to obtain the conclusion of an expert commission;

- To apply for a pension for a disabled child, to do this you need to contact the pension fund with a passport, birth certificate, medical certificate and proof of residence in the Russian Federation.

Read also: Low-income single mother: payments, benefits and benefits

Conditions

Design nuances:

- Social payments are issued to one of the parents, grandparents, adoptive parents or other relatives.

- Social benefits can only be applied for by a citizen of working age who is not working.

- If a person receives a pension, unemployment compensation, wages or other income, then he is not entitled to assistance from the state.

- Assistance is paid until the ward reaches the age of majority or until the expiration date of the medical certificate.

- After 18 years of age, social benefits are only available to caregivers of disabled people of the first group.

- The recipient can only be one person.

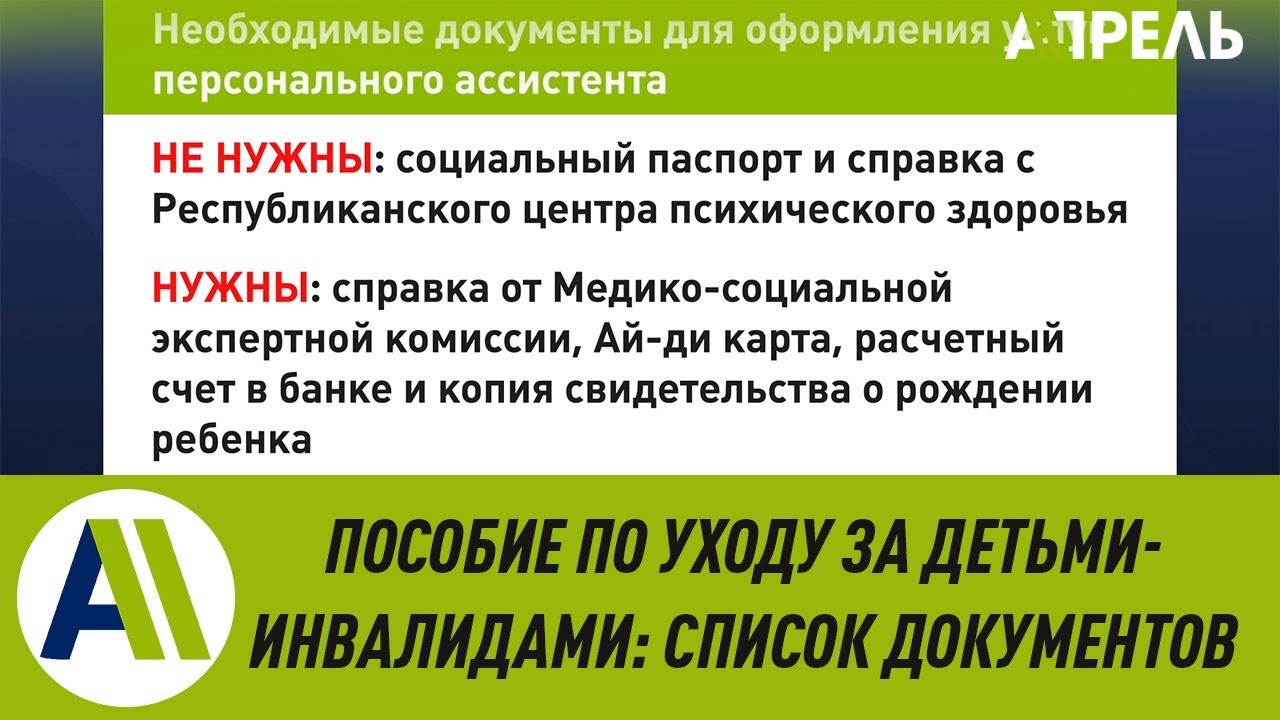

Documentation

It is possible to apply for this type of social benefits at a branch of the Pension Fund, MFC, through the State Services portal.

Required package of documents:

- guardian's identity document (passport) with a copy;

- SNILS and photocopy;

- birth certificate of a disabled person;

- a document from the Pension Fund of the Russian Federation stating that the applicant does not receive a pension;

- an extract from the Employment Center stating that the potential recipient of the money is not registered;

- the applicant's ore record book;

- medical examination report confirming childhood disability;

- personal statement;

- Sometimes additional documents may be required: a birth certificate of one of the parents (if the grandmother arranges care), a military ID, a certificate of residence, a court decision, etc.

The application must indicate:

- Last and first name of the child and the person who will provide care.

- Contact information, including phone number.

- Passport data.

- Day, month and year of birth of the ward.

- Complete list of attached documents.

Benefits for non-working parents: payment procedure (documents)

The first years of a child’s life not only take a lot of effort and time from the parents, but also, as a rule, deprive one of them of the opportunity to work, and therefore earn an income.

But the state, showing concern for the new generation, provides financial support to those parents who are forced to temporarily give up work.

In this article we will tell you about benefits for non-working parents, and consider the procedure for applying for and receiving them.

For example, a non-working parent who cares for a child up to a certain age is paid an appropriate allowance. Moreover, he receives it regardless of whether he worked until that moment or not. The only difference is that in the first case the average earnings will be calculated, and in the second the benefit will be equal to the minimum amount of social security.

Who is eligible for benefits?

Benefits for citizens with children, including the unemployed, are regulated by Federal Law No. 81-FZ of May 19, 1995. Child benefits in the form of social security are provided to the following unemployed parents:

- dismissed due to the liquidation of a company or individual entrepreneur and recognized as unemployed, within 12 months after dismissal until the birth of a child;

- dismissed due to liquidation of a company or individual entrepreneur while on maternity leave;

- unemployed and students.

Benefits for non-working parents

Let's look at the types of payments in the table:

Name of benefit Who is entitled Amount of benefit for 2017, rub. For pregnancy and childbirth

- women who lost their jobs due to the liquidation of a company or individual entrepreneur, termination of the status of a lawyer or notary, etc.

- wives of Russian military personnel located on the territory of another state;

- women studying in professional organizations, universities and additional education organizations on a full-time basis;

- women who adopted a child

- 100% of average earnings, or based on the minimum wage:

- 34521.20; 38466.48 – complicated childbirth;

- 47836.52 – multiple pregnancy.

One-time benefit for women registered in the early stages of pregnancy All women registered before the 12th week of pregnancy 613.14 One-time benefit for the birth of a child One of the parents or a person replacing him 16350.33 One-time benefit for the placement of a child in foster care to the family The parent who adopted the child, or who took him under guardianship (trusteeship) 16350.33 One-time benefit for the wife of a military man Wife of a military man serving on conscription (pregnancy period 180 days or more) 25892.45 Monthly benefit for the child of a military man Mother (guardian) of a child of a military man , who is serving on conscription 11096.76

Monthly child care allowance

- Mother, father, guardian, or other relatives of the child, dismissed during the liquidation of the company, or individual entrepreneur, termination of the status of a notary, lawyer, etc.;

- Mother, father, guardian or other relatives studying in professional organizations, universities and additional education organizations on a full-time basis.

3065.69 – for the first child; 6131.37 – for the second child and subsequent ones.

Procedure for applying for benefits for non-working parents

In order to apply for child care benefits for a non-working person, you must first decide which body you need to contact. You can submit documents by contacting one of three authorities:

- MFC (in person);

- Government services portal (via website);

- Ministry of Social Development of the Population (personal).

For those women who find themselves unemployed as a result of the liquidation of a company, they do not have the opportunity to turn to their employer for the required payments. There are regulations specifically for this case (approved by Order No. 653n dated September 22.

2014), on the basis of which you can apply for payments directly to the Social Insurance Fund in which the employer was a member before the liquidation of the organization. article: → “Procedure for payment of compensation upon dismissal due to staff reduction.”

Submit the required list of documents to the government agency. When applying for payments, unemployed citizens will need to provide the following list of documents:

Manual List of documents For pregnancy and childbirth

- Applicant's passport;

- Child's birth certificate;

- Child's birth certificate;

- A document confirming the status of unemployed;

- Certificate from the Social Insurance Fund about non-receipt of benefits

One-time benefit for the birth of a child

- Applicant's passport;

- Child birth certificate;

- Child's birth certificate;

- A document confirming the fact of unemployment;

- Certificate from the Social Insurance Fund about non-receipt of benefits

One-time benefit when placing a child in a family

- Applicant's passport;

- Child adoption certificate;

- A document confirming the fact of unemployment;

- Certificate from the Social Insurance Fund about non-receipt of benefits

One-time benefit to the wife of a military man

- Applicant's passport;

- Marriage certificate;

- Certificate from the husband’s military unit;

- Certificate from the antenatal clinic where the woman is registered

Monthly allowance for a child of a military personnel

- Applicant's passport;

- Child's birth certificate;

- Certificate from father's military unit;

If necessary: a document confirming the fact of guardianship, death certificate of the mother, etc.

Monthly child care allowance

- Applicant's passport;

- Birth certificate of the child being cared for and previous children;

- Certificate of full-time study;

- A certificate from the other parent’s work confirming that he did not receive this payment;

- Certificate of cohabitation with the child;

- Certificate of benefits received previously.

After submitting the application, you must wait no more than 1 month for a decision on payment of benefits.

Ways to receive payment

Non-working parents can receive the intended payments in one of two ways:

- transfer to the personal bank account specified in the application;

- by postal order, for receipt at Russian Post.

Calculation of child care benefits in the Social Insurance Fund

When they apply for maternity benefits not to the employer, but directly to the Social Insurance Fund, for example, as in the case of liquidation of an enterprise, social insurance makes the calculation independently. The calculation procedure used is the same as in organizations. article: → “The procedure for assigning maternity benefits to the unemployed.”

The calculation formula is as follows:

EPR = SDZ x 30.4 x 40%,

- where EPR is the amount of monthly child care benefit for children up to 1.5 years old;

- SDZ is the average daily salary for the last 24 months before going on maternity leave.

Example 1. Petrova O.P. was on maternity leave. At this time, the company was liquidated, and the employer could not be found.

The salary for the last 2 years was 650,000 in 2015 and 690,000 in 2016. To assign child care benefits, Petrova contacted the Social Insurance Fund, providing all the necessary documents.

Based on these data, the FSS calculated the benefits:

- SDZ = 1,340,000 / 731 days for 2 years (if there are no deductible periods) = 1,833.10 rubles.

- EPR = 1,833.10 x 30.4 x 40% = 22,290.50 rubles.

Refusal to pay benefits

In some cases, unemployed citizens may be denied benefits, for example:

- The applicant provided an incomplete package of documents;

- The applicant does not have the right to assign benefits;

- Inconsistencies were identified in the documents provided by the applicant;

- The applicant knowingly provided false information;

- The child is completely supported by the state;

- Deprivation of parental rights;

- Applying for payment after the due date.

Pension for non-working parents

Let's consider cases when parents are paid a pension for caring for a child, or more precisely for a disabled child. The child’s natural parents, as well as guardians or trustees caring for a disabled child, cannot work during this period and receive income. But they have the right to count on appropriate payments from the state in the amount of:

- 5,500 rubles – to one of the child’s natural parents or guardian;

- 1200 rubles – to another person providing care.

In order to receive such a pension, you must contact the pension fund, which pays a pension to a disabled child.

In addition to the application, one of the parents or guardian needs to confirm the fact of the child’s disability, as well as the fact of their own ability to work and the status of the unemployed. Together with a pension for a disabled child, in the same way. article: → “An example of recalculating pensions for children.”

It is recommended to study the following laws:

Legislative act Date Contents Law No. 81-FZ 05.19.1995 “On state benefits for citizens with children” Law No. 178-FZ

Source: https://kompensacii.ru/poryadok-polucheniya-posobij-dlya-nerabotayushhix-roditelej/

The Ministry of Labor will think about paying benefits to working parents of disabled children | Mercy.ru

Prime Minister Dmitry Medvedev will instruct the issue of maintaining payments for the care of disabled children for working parents. He announced this during a meeting with activists of local and primary branches of United Russia, responding to an appeal from an activist from the Moscow region.

“Many mothers raising disabled children are forced not to work, and they receive social compensation in the amount of 10 thousand rubles - this is not a lot of money,” the woman said. “And after some time, they would like to go back to work, but if they receive additional income, then all compensation will be canceled.

And it’s probably simply necessary (because, as they say, there is no such thing as extra money, especially in families where there are special children) to save all these compensations and subsidies for parents who would like to go to work and who have such an opportunity.”

“If I understand you correctly, with part-time work, when a mother, for example, goes to work in order to maintain both benefits and, accordingly, wage payments, I will say that this is still contrary to the current legislation,” said Dmitry Medvedev.

“The point of this benefit was precisely to completely free one of the family members in order to care for a child who has problems. This was the purpose of this benefit: either you need to stay at home and take care of the child, or go to work.”

“But I perfectly understand the subtext of the question - this manual is small, it, of course, covers some basic things, but nothing more. Let us think about how to develop this institution. I will instruct the Ministry of Labor and Social Development to think about whether it is possible to combine both goals here. And, I won’t hide, of course, this has to do with money,” the prime minister explained.

“If a mother caring for a disabled child still manages to work, then she is deprived of all social benefits,” Elena Klochko, .

- This is not very correct, in my opinion, because a parent does not go to work part-time because of a good life. It would be good to keep social benefits so that the parent can have income in addition to social benefits.

I think that everyone in the state will be better off from this, and no one will be worse off.”

“It is impossible to survive on either 5 or 10 thousand. Therefore, those who receive this benefit do not want to lose it, but at the same time want to survive and earn a little extra money, are simply forced out into the shadow economy,” said Ekaterina Men .

Earlier, VORDI spoke about violations by the territorial departments of the Pension Fund of Russia, which in some cases deprived activists of this organization of benefits for caring for disabled children. The reason was the unlawful assessment of social activities as employment, depriving the right to benefits, VORDI stated then.

Source: https://www.miloserdie.ru/news/mintrud-podumaet-o-sohranenii-posobiya-po-uhodu-za-detmi-invalidami-rabotayushhim/

Labor benefits for parents of disabled children

For children with a disability group, the Russian Government has provided a set of social support measures. They are expressed in the payment of benefits at the expense of state and regional budgets, compensation for a number of expenses and benefits in various areas.

Parents with disabled children employed under labor contracts can also receive financial support in connection with the maintenance of a child with an increased level of needs.

To what extent labor benefits are provided to citizens, where to apply and what documents are needed to apply for such benefits are detailed in the article.

Benefits for parents of disabled children during employment

When applying for a job, citizens are not required to inform the employer that they are supporting a disabled child who requires increased care due to disabilities. The management of the enterprise has no right to refuse to accept a position due to the fact that there are minor children in their care who are not able to care for themselves independently.

After drawing up an employment contract, the employee has the right to provide the personnel service with all documentation for the child, including the conclusion of the Bureau of Medical and Social Expertise on the health status of the ward, for the calculation of benefits. They apply for the period:

- before the expiration date of the medical and social examination act, usually issued for 1 year;

- until the child’s complete recovery, when adaptation measures are not required;

- if he reaches adulthood - 18 years old.

What labor benefits are provided to parents of a disabled child?

Among the measures that an employer must observe when hiring parents of children who need increased social support are established by law:

Name Description Features Additional days off and vacation days The Labor Code provides for additional time for caring for a sick child of 4 days every 30 days. If one of the parents is officially employed, and the other helps the child at home, then all days are provided to the parent who works. Both the mother and father, or other legal representatives, for example, adoptive parents, can take days off. Each of them can receive 4 days of rest monthly or in total per each parent. Sick leave For each disabled child, leave will be paid in full for 120 days a year, if adults are required to stay with the minor in a medical institution constantly. Leave is also provided if the parents must provide full care for the child, but are not in the hospital full time. Partial shift or part-time workweek It is possible to establish special working hours:

- · reduction of working days weekly (partial week);

- · working an incomplete number of hours (reducing the shift or working day);

- · reducing the number of hours of work or days during the week - a combination of work modes is possible.

Such changes are possible only if a written agreement is drawn up between the employer and the employee on a permanent basis or the specialist gives consent to the temporary introduction of such a regime due to the need for enhanced child care. Work on weekends, holidays, and on a rotational basis is carried out only with the written consent of the employee. If they refuse to agree on the introduced work schedule, another employee is involved in their work, since such a regime is not forcibly allowed for persons who support children. Early pension Based on Federal Law No. 400, Article 32, such a benefit is provided only if you have a special work experience, which for women is 15 years, and for men - 20 years. Registration is carried out at the pension authorities. A list of documentation on the health status of the disabled child is provided.

Expert opinion

To receive employment benefits, an employee must take the initiative. He needs to contact the personnel department with an application for additional days of leave in connection with caring for a disabled child within a month. Once the date is approved, the employer is required to give time off for a valid reason. Vacation days are not automatically included in the staffing table.

Doronnikova R.G., HR department employee

- Features of the introduction of staff reduction measures for parents of disabled children in 2020

- When staffing is reduced at an enterprise, dismissal is carried out in relation to persons who support disabled children, in the last place. Termination of employment relations with them is allowed only in the following cases:

- · repeated violations of labor discipline - absenteeism, failure to perform official duties, subject to notification to the employee;

- · upon complete liquidation of the company with the entry of the relevant data into the Unified State Register of Legal Entities;

- · in case of a one-time serious violation of labor functions, for example, not going to work, absenteeism for more than 6 hours, without explanation.

Payment for additional days off for parents of a disabled child

Additional days consisting of 4 days within 30 calendar days are subject to payment from the Social Insurance Fund of the Russian Federation. Money is paid to both mother and father from the state budget, if they are employed.

Important: An application for payments is submitted through the personnel department at the place of employment or, in the absence of special management, is transferred directly to the head of the enterprise. The money is transferred by the enterprise directly to the employee, then the company receives compensation from the Federal Social Insurance Fund of the Russian Federation.

The social insurance authority does not have the right to refuse to pay 4 additional days to the parents of a disabled child if the employee is employed part-time or used rest days at another place of employment.

Documents for receiving payments for additional days off

At the place of work, parents of a disabled child must provide a package of documents. It includes the following papers:

Name Who draws up/issuing authority Explanation Application for compensation for additional days required to care for a disabled child Parent-employee of the company with which the employment contract is concluded The paper is drawn up in any form, no special requirements are presented Birth certificate Registry office authority at the place of birth of the minor Sufficient present to the HR department or manager once. Identity card For a disabled child over 14 years of age. Registration at the passport office at the place of registration is required. Certificate of registration of individual entrepreneurs If the mother or father is registered as an individual entrepreneur, then they are not entitled to a payment package for 4 days off per month. You can obtain the document from the Office of the Federal Tax Service of the Russian Federation at your place of registration. Reimbursement of pay for weekends is carried out by the Federal Social Insurance Fund of the Russian Federation only to parents or legal representatives working under employment contracts. Certificate of unemployed status and work book Issued by the Employment Center to a parent who is not employed. A copy of the work book with a note indicating temporary absence from activity is also provided. If one of the relatives does not work, then the other, employed under an employment contract, may be compensated at the enterprise at the expense of the Social Insurance Fund of the Russian Federation. Certificate from the place of work of the second parent The document must confirm the absence of payments at the place of employment of the second parent for the month in which payment of additional days off is requested. Such a document is needed if both parents are employed, but are entitled to additional days of rest in connection with raising a disabled child, but one of them receives compensation. Certificate of divorce, court decision on deprivation of parental rights, confirmation of the death of the second parent - court decision or certificate If the family relationship has been terminated and one of the parents is responsible for maintaining the child. Issuing issuance If a document on divorce is provided, there is no need to request documentation on the provision of payments at the place of work of the second parent/legal representative. Certificate stating that the child has not been sent to a special institution. Confirmation that disabled children are not kept in social institutions, for example, a boarding school, is issued by the USZN. To confirm that the minor is not provided by government services and the costs of his maintenance are borne by the parents.

All documents must be provided every month, except for the conclusion of the Bureau of Medical and Social Expertise on the state of health of a disabled child; the examination is carried out once a year. You also do not need to copy your birth certificate every time.

The normal acts regulating labor benefits for parents of minor children with disabilities include:

- Article 262 of the Labor Code of the Russian Federation - the norm indicates the possibility of obtaining additional days of leave for children with a disability group;

- Article 263 of the Labor Code of the Russian Federation – on additional compensation for unpaid leave for parents whose dependent children are with physical or mental disabilities.

Additional measures to support parents raising a disabled child in 2020

In addition to labor benefits, the following benefits are provided for legal representatives of children with disabilities:

- issuing subsidies to improve housing conditions;

- reimbursement or discounts for housing and communal services;

- payments from the budgets of regional authorities;

- vouchers to sanatoriums for treatment and travel passes to the place of receiving medical services;

- tax relief.

In 2020, tax deductions for working parents apply to children in the following amounts:

- 12,000 – for mother’s and father’s relatives;

- 6,000 – for appointed guardians.

Tax benefits are provided to each parent in the specified amount. In the absence of one of them - double the amount for a mother or father raising a disabled child alone.

The maximum total annual income for the benefit should be RUB 360,000. If the specified limit is exceeded, mandatory payments are accrued in the general mode.

After the new tax period, the benefits are resumed.

Common Mistakes

Error 1. The employer refused to conclude an employment contract for a citizen who is supporting a disabled child, due to the need to provide him with the benefits provided for by the Labor Code of the Russian Federation.

An employee is not required to notify the organization’s management when applying for a job about the child’s health condition. The presence of such children is not a basis for refusal to conclude an employment contract. If there is a restriction on occupying a vacant position, a complaint can be filed by a potential employee with the Labor Inspectorate and the court.

Error 2. The father of a child with a disability operates as an individual entrepreneur. He applied to the Federal Social Insurance Fund of the Russian Federation for compensation for 4 additional days off in connection with caring for a minor. He was denied payment.

The refusal was made legally, since compensation from the state budget by the social insurance body is provided only for employees performing functions under an employment contract. This norm is specified in the Labor Code of the Russian Federation and is not provided for persons engaged in individual entrepreneurial activities.

Question answer

Question 1. Can 4 additional days not taken off in the current month be transferred to the next period?

This possibility is not provided for under labor legislation. The application is submitted to the employer every month along with a supporting set of documents. In its absence, leave is given in the next period also for no more than 4 additional days. They cannot be transferred by law.

Question 2. When does an employee have the right to take 14 days of unpaid leave in connection with raising a child with a disability?

These days may be added to annual leave. They cannot be transferred to the next period – calendar year.

- Benefits for the medal “For Labor Valor” in 2020.

- The benefits of an honored builder are a complete list.

Case from practice

Ivanova R.Sh. When applying for a job, she did not indicate that she was supporting a child with a disability group. A month later, she needed to take him to a sanatorium for treatment; she wrote an application for leave for 4 days.

She was denied days off and her employment contract was terminated, citing the fact that she had not warned management about the child’s condition and the need to provide him with additional care.

Ivanova wrote a complaint to the Labor Inspectorate and the head of the enterprise was held accountable for violating the requirements of the Labor Code of the Russian Federation and pointed out the need to eliminate illegal actions - reinstate the citizen in her workplace, accept her application, provide the requested leave and make compensation from the funds of the Social Insurance Fund of the Russian Federation.

Benefits for working parents of a disabled child in 2020

Source: https://poluchi-lgoty.ru/lgoty-rabotayushhim-roditelyam-rebenka-invalida/

Question to Putin: why do only non-working able-bodied parents or guardians receive benefits for caring for disabled people?

vk.com/ilya_popenov

A resident of Yekaterinburg, Ilya Popenov, posted on his page on the social network VKontakte an appeal to Russian President Vladimir Putin, in which he asks him to sort out the fact that only non-working, able-bodied parents or guardians receive benefits for caring for disabled people. The appeal states that, according to current legislation, parents are deprived of benefits upon retirement. At the same time, they continue to care for their disabled children until their death, even if they have a disability.

Ilya Popenov reminded the president that on March 7 he signed decree No. 95 on increasing the amount of benefits for the care of disabled children and people with disabilities from childhood of group I. From July 1, the amount of this benefit will be 10 thousand rubles.

At the same time, the document states that only able-bodied parents or guardians will be able to receive it.

Only “other persons” can count on receiving benefits, and the amount of the benefit is only 1,200 rubles, and hardly anyone will agree to care for a person with a disability for that kind of money.

In his address, Ilya Popenov noted that bill No. 727491-7 “On monthly compensation payments to persons caring for group I disabled people” has been submitted to the State Duma. It proposes to set the amount of benefits for caring for disabled people of group I in the amount of 10 thousand rubles, but there is a reservation: “With the exception of disabled people of group I since childhood.”

“Why such injustice? – asks Ilya. – Retired parents cannot be paid for care; “other persons”, who must also be unemployed and able-bodied, will not care for 1200. Parents die, and a disabled person should have the right to hire someone at least part-time. We ask you to pay attention to this sensitive issue.”

Previously, we reported that Russian President Vladimir Putin signed decree No. 95 dated 03/07/2019 “On amending the Decree of the President of the Russian Federation dated February 26, 2013 No. 175 “On monthly payments to persons caring for disabled children and people with disabilities since childhood Group I"

This decree increases the amount of payment for caring for disabled children and people with disabilities since childhood to 10 thousand rubles. Currently, the amount of payment for the care of disabled children and people with disabilities from childhood of group I is 5.5 thousand rubles. The last time it increased was in 2013.

From July 1, 2019, the payment amount will increase to 10 thousand rubles.

We also wrote that bill No. 727491-7 “On monthly compensation payments to persons caring for group I disabled people” has been submitted to the State Duma.

The bill proposes to establish the amount of compensation for caring for disabled people of group I in the amount of 10 thousand.

rubles and index it annually based on the consumer price growth index. The expected date of entry into force of the new law is January 1, 2020.

Let us recall that Decree of the President of the Russian Federation dated December 26, 2006 No. 1455 “On compensation payments to persons caring for disabled citizens” provides for the provision to non-working able-bodied persons caring for a disabled person of group I (with the exception of disabled people from childhood of group I), as well as for for the elderly who, upon conclusion of a medical institution, need constant outside care or who have reached 80 years of age, receive monthly compensation payments. Its size is 1200 rubles. It was installed in 2008 and has never been indexed since then.

Source: https://dislife.ru/materials/2407

Pension of a disabled child - amount, exact amount

At the legislative level, disabled children are provided with a social pension until they reach adulthood.

Plus, monetary compensation from the state is provided for persons who are considered able-bodied, but who provide constant care for a child with disabilities (or several children).

The listed payments are calculated in accordance with current legal acts. Compensation for adults has not changed since 2013, but the pensions of disabled children are indexed annually.

Conditions for assigning social benefits to a disabled child

- The status of “disabled child” gives its holder the right to receive a pension from the moment they are assigned to this category. The statute implies that a minor citizen:

- - has a disease that affects important functions of the body, so that a full life becomes impossible due to limitations (motor, visual, auditory, etc.);

- - is not able to serve himself partially or completely without the help of others;

- - must undergo regular rehabilitation under the supervision of specialists.

- The assignment of status occurs within the framework of a special medical commission, which takes into account the opinions of doctors, examination data and other important information related to this issue.

As before, in 2020, social pension payments for a disabled child are made based on the Federal Law on State Pensions No. 166-FZ of December 15, 2001 (Articles 4, 11, 18). As noted above, a disabled person’s pension is paid until his 18th birthday. After this, based on the examination, a group is given (the severity of the condition, self-care skills, etc. are taken into account).

Now, instead of the previous status, a person with disabilities is considered “disabled since childhood.”

Social pension for disabled children

Disabled children receive the same pension regardless of their age and disability. Taking into account last year’s indexation of 2.9%, the social pension for minor citizens with disabilities was 12,432 rubles in 2019. 44 kopecks

Let us recall that Article 25 of Law No. 166-FZ regulates the indexation (recalculation) of payments on April 1, and for everyone, not just for children. The coefficient, taking into account which the social pension will change, is determined by the Government of the Russian Federation. In particular, this value is calculated based on price increases over the past year, while the exact value of the coefficient is unknown in advance.

Be that as it may, in 2020 social pensions will be increased by 7%, that is, 13,568.77 rubles . (the increase is equal to 887.68 rubles).

Amount of compensation for caring for a disabled child

A person caring for a sick minor is entitled to monthly compensation. This payment is necessary because the process of caring for a disabled child does not allow his parent (guardian) to get a job. There is no social pension provided for parents, relatives or guardians who are forced to care for an unhealthy child.

There is only compensation paid on the basis of Decree of the President of the Russian Federation of March 7, 2019 No. 95. It is noteworthy that the amount of the payment is related to the status of its recipient.

That is, blood and adoptive parents, as well as a guardian or trustee, have the right to receive 10,000 rubles every month for care, while other persons considered to be caring for a disabled child can be provided with 1,200 rubles.

Only able-bodied (in terms of health and age) but unemployed citizens are considered as applicants for compensation. However, payment of compensation stops when the child with a disability becomes an adult. Later, only those who are caring for an adult disabled from childhood of group 1 can receive the amount.

And in areas with difficult (difficult) climate conditions, the coefficient relevant for the given area is applied to payments and pensions.

How much do disabled children receive?

Who is caring? Pension EDV Amount Parent or guardian Other NSO benefits NSO money Minimum Maximum 10000 1200 12681.09 1580.26 2701.67 15461.35 25382.76

Social pensions for disabled children

Adult citizens recognized as disabled since childhood are provided with a social pension until official employment. And even if such an employee only works for a day or two, instead of a social pension he will be assigned an insurance pension in accordance with Article 9 of Law No. 400-FZ of December 28, 2013.

In general, the social benefits of disabled people from childhood are directly related to the group assigned to them. In other words, holders of group 1 childhood disability receive 12,681 rubles. 9 kopecks If you have group 2 childhood disability, you are entitled to 10,567 rubles. 73 kopecks, and for group 3 childhood disability - 4,491 rubles. 30 kopecks

These pensions are also subject to annual recalculation in April.

How much do disabled people of groups 1, 2 and 3 receive in total?

Disability group Social size pensions EDV Amount of NSU benefits NSO money Minimum Maximum Disabled people since childhood, group 1 12681.09 2661.52 3782.94 15342.61 16464.03 Disabled people since childhood, group 2 10567.73 1580.26 2701.67 12147.99 13269.40 Disabled people with childhood 3 groups 4491.30 1041.20 2162.62 5532.50 6653.92

What should parents of children with disabilities do?

To ensure that a parent who has devoted most of his life to caring for a disabled child does not lose the right to a pension, he will be credited with a length of service of 1.8 pension points for each year.

Some regions have their own additional payments to parents of disabled children: in Moscow, once a year you can receive 10,000 RUR for a school uniform, and every month - 12,000 RUR for care and 675 RUR as compensation for the increased cost of food if the child is under three years. True, parents who already receive regional payments will have to refuse federal assistance.

Parents of disabled children are entitled to four additional paid days off per month. They can be divided among themselves in any proportion.

One of the parents has the right to take leave at any convenient time. You can extend it for 14 days without saving your salary - these additional days can also be taken at any convenient time, even added to the main vacation.

If the parent of a disabled child requests, the employer is obliged to establish part-time work for him. Parents of disabled children may refuse to work at night, on weekends or overtime and to be sent on business trips.

An employer can fire a parent who is raising a disabled child alone only for gross violation of labor discipline - for example, if the parent committed absenteeism or provided false documents.